Redefining Banking Intelligence with AI-Driven Core Transformation

Coligo CBS and ibanker bring AI-first speed, clarity, and control to every layer of modern banking.

Coligo represents a paradigm shift in banking technology - delivering a comprehensive AI-driven core banking suite that transforms how financial institutions operate.

At the heart of this ecosystem lies ibanker, our flagship AI copilot, designed to solve one of the most critical challenges in banking today - the information asymmetry between frontline operations and C-suite decision makers.

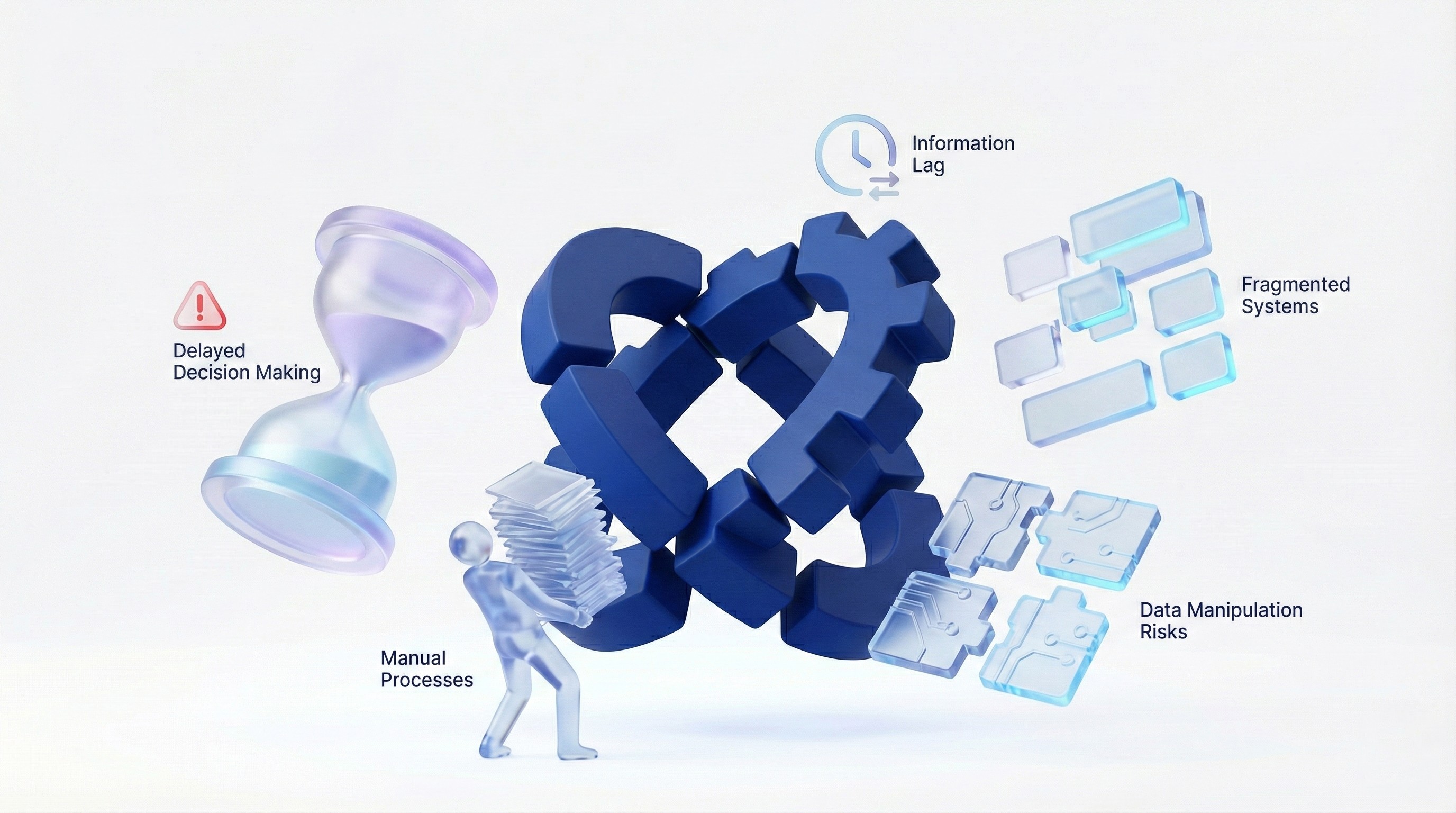

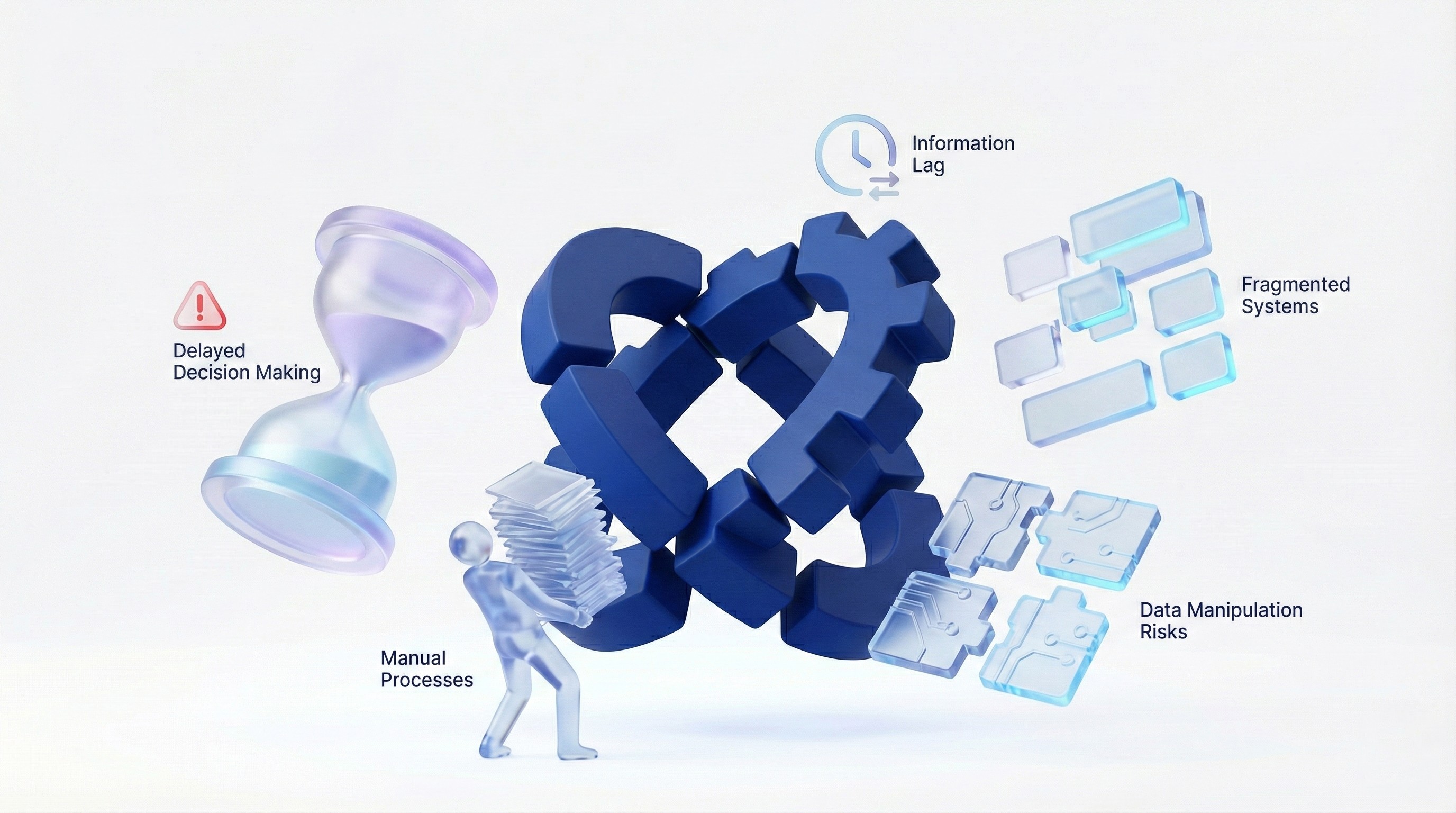

Information Crisis & Operational Inefficiency

In an environment where micromanagement across thousands of branches and millions of transactions is impossible, leaders face systemic barriers that impact efficiency and risk visibility.

Information Asymmetry Crisis

- Delayed Decision Making: Traditional reporting cycles take days or weeks.

- Data Manipulation Risks: Critical insights often filtered, outdated, or incomplete.

- Information Lag: Market and risk conditions evolve faster than reporting.

- Cascading Impact: Outdated NPAs, false profit trails, or hidden losses can trigger million dollar mistakes.

Operational Bottlenecks

- Manual Processes: Paper heavy workflows delaying loan origination by 2-3 days.

- Compliance Complexity: RBI compliance requiring intensive manual checks.

- Fragmented Systems: Disconnected platforms creating data silos.

- Resource Overheads: High operational costs from redundant human interventions.

The Coligo Ecosystem

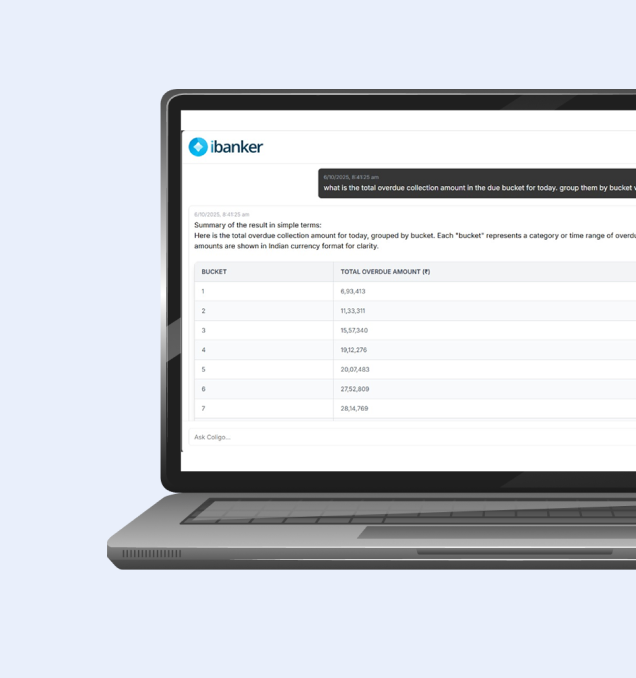

ibanker overlays seamlessly on existing banking infrastructure to deliver real-time, natural language access to live banking data - no data exports, no intermediaries.

Revolutionary Capabilities

- Natural Language Queries: Ask, "What is the NPA at any branch right now?" or "How many loans were disbursed yesterday across South India?"

- Real-Time Intelligence: Direct, unfiltered access to live data.

- Workforce Management: Agentic AI tracks productivity through employee audit trail analytics.

- 360 Degree Insights: Unified view of portfolios, risk, and operational KPIs.

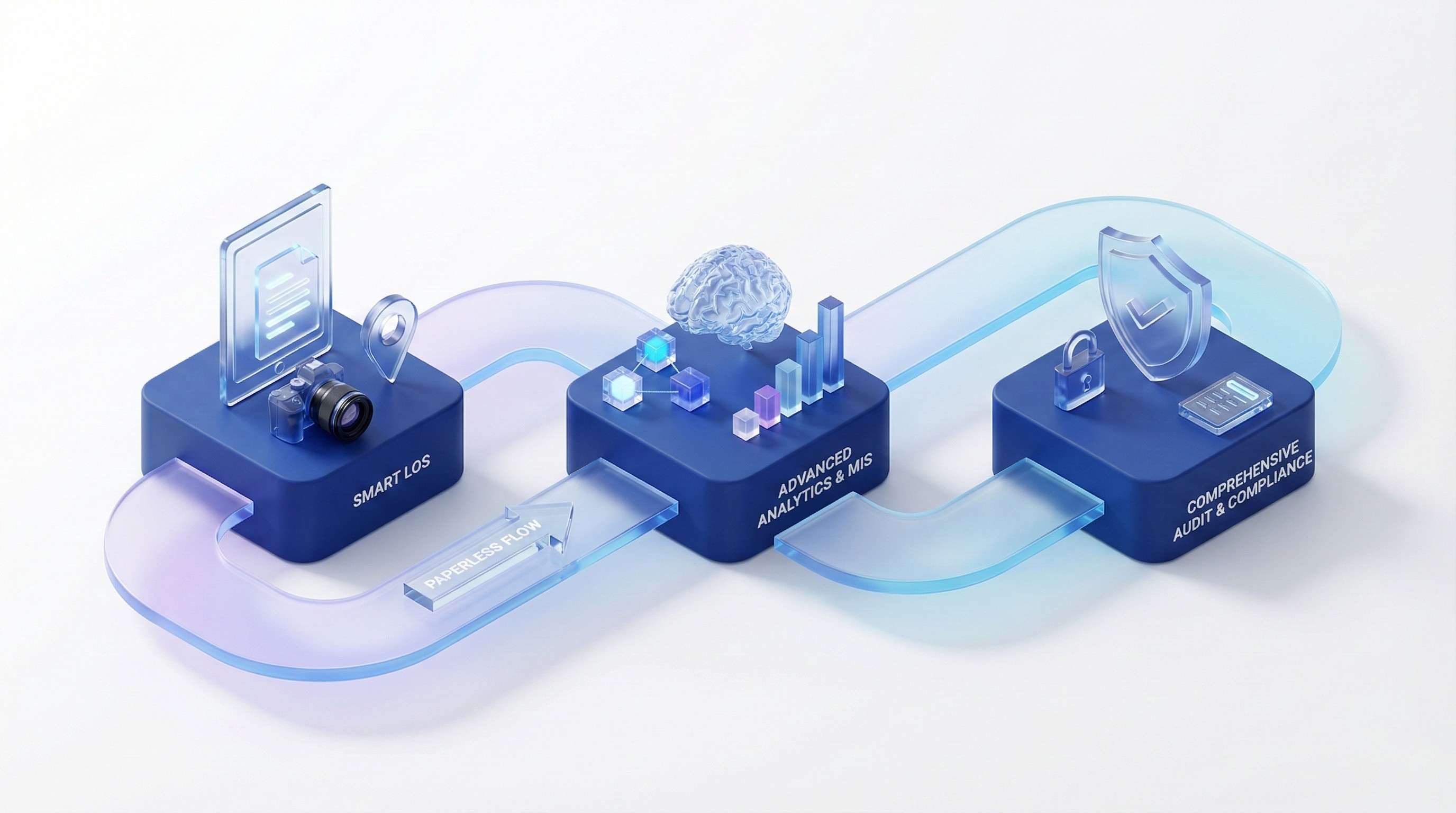

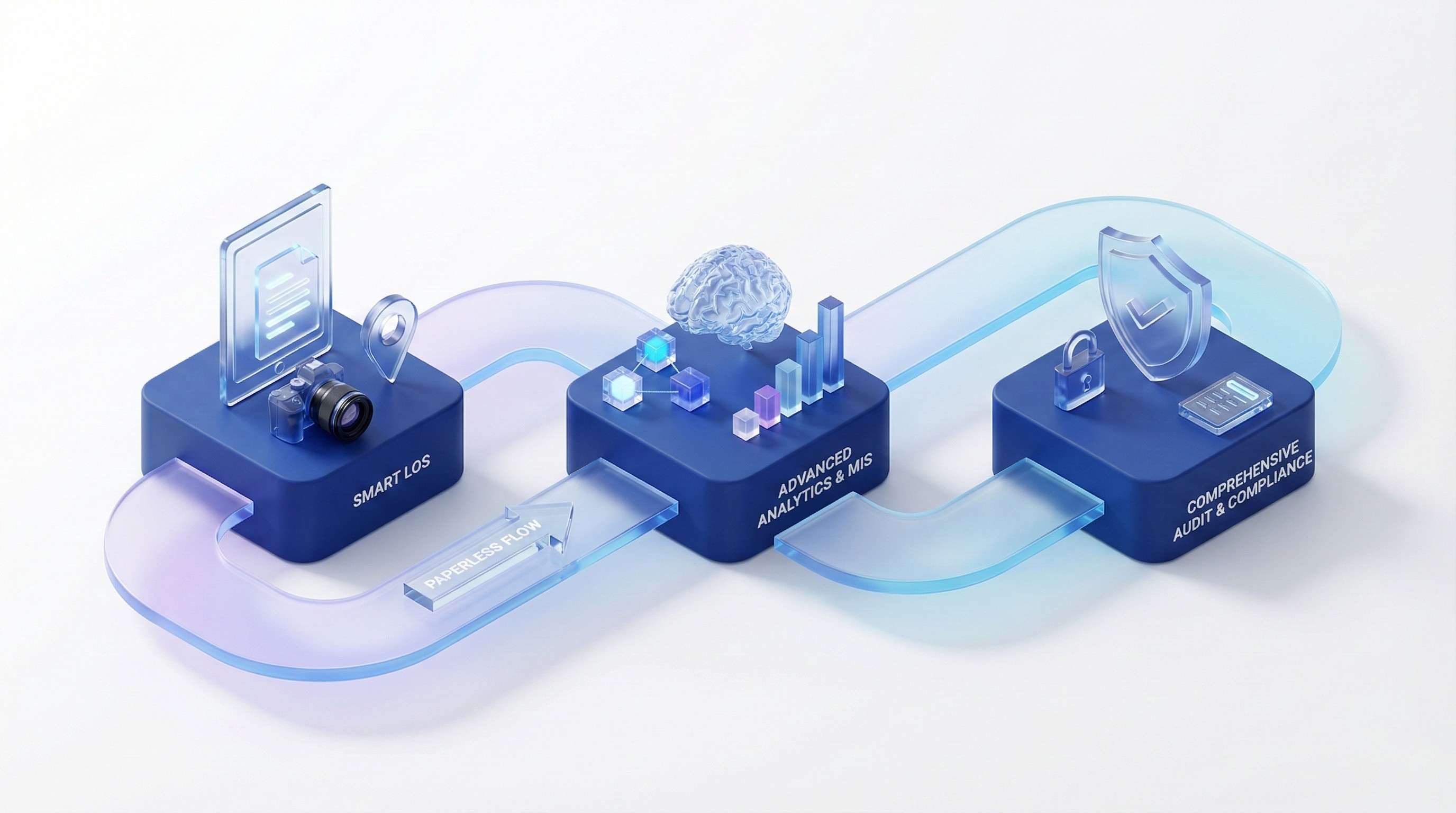

The Complete AI-Driven Banking Suite

Smart LOS (Loan Origination System)

- 100% paperless processing with AI document capture.

- AI camera and geo-fencing for KYC and field staff tracking.

- Proven TAT reduction: From 2-3 days to 15 minutes (validated by Manappuram Asset Finance).

Advanced Analytics & MIS

- Digital Cell Technology: High-performance ETL engine for large-scale data.

- LLM-powered ALM: Real-time control over asset-liability management.

- Zero Excel dependency: Eliminate redundant manual reporting.

Comprehensive Audit & Compliance

- Real-time financial and system audit with complete traceability.

- Automated RBI-compliant reporting and end-to-end adherence tracking.

Technical Excellence & AI Innovation

Purpose built architecture and decisioning pipelines ensure that AI is trustworthy, explainable, and deployable at scale across regulated banking environments.

AI-Powered Credit Decisioning

- Data scrubbing and validation for error-free underwriting.

- Business Rule Engine (BRE): Automated pre-approvals and cross-selling.

- Early Warning Signals (EWS): Predictive analytics for proactive risk control.

Cutting-Edge Architecture

- Data Layer: AI, ML, vector DB, big data, RAG for real-time insights.

- Database: Multi-tenant, cloud-ready, and highly scalable.

Revolutionary Breakthrough

Converts natural language queries into precise SQL operations against complex banking schemas using:

- Advanced RAG implementation for schema identification.

- Domain-tuned LLMs optimized for banking terminology and compliance.

- Privacy-first architecture with encrypted processing and full audit trails.

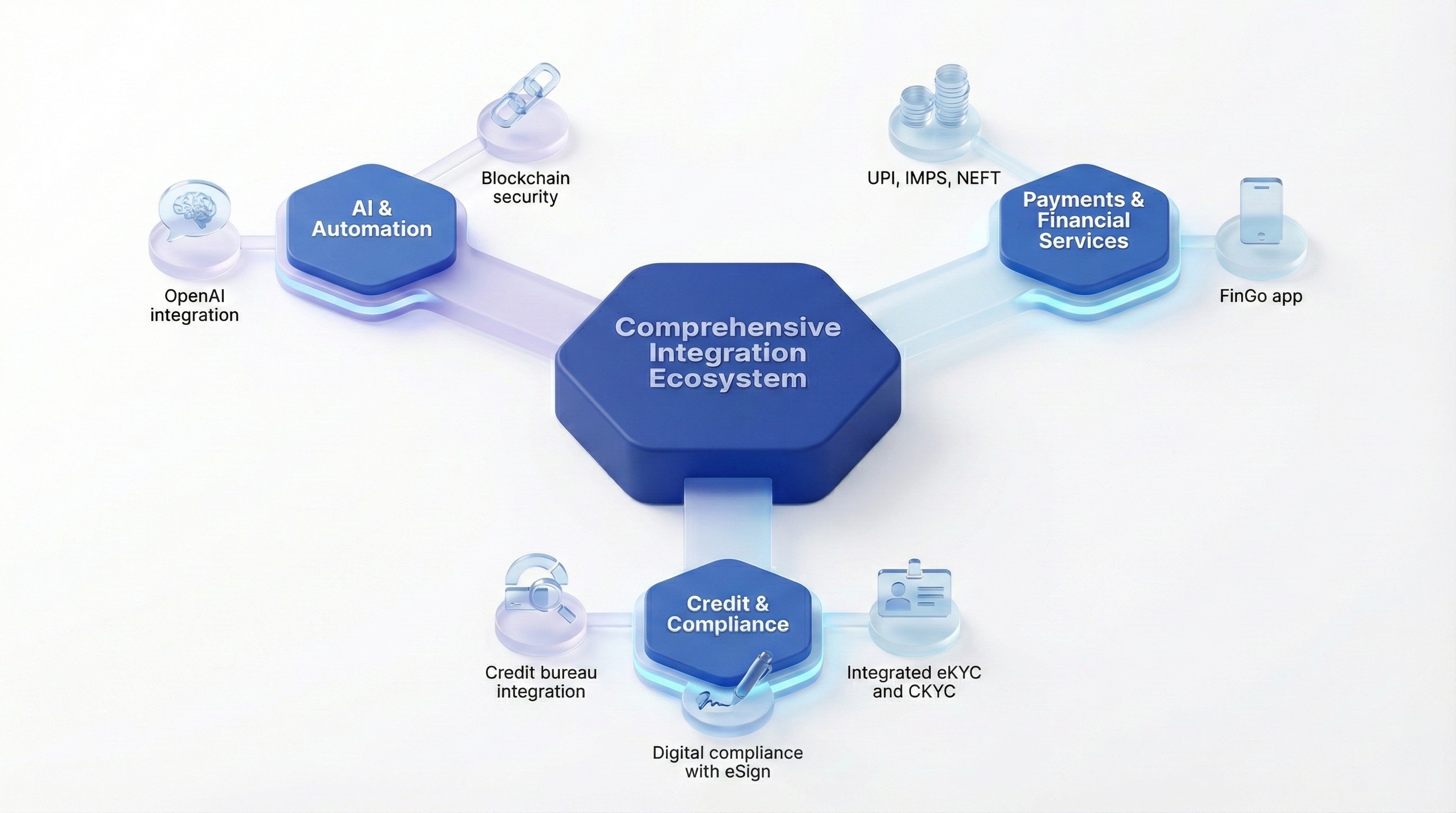

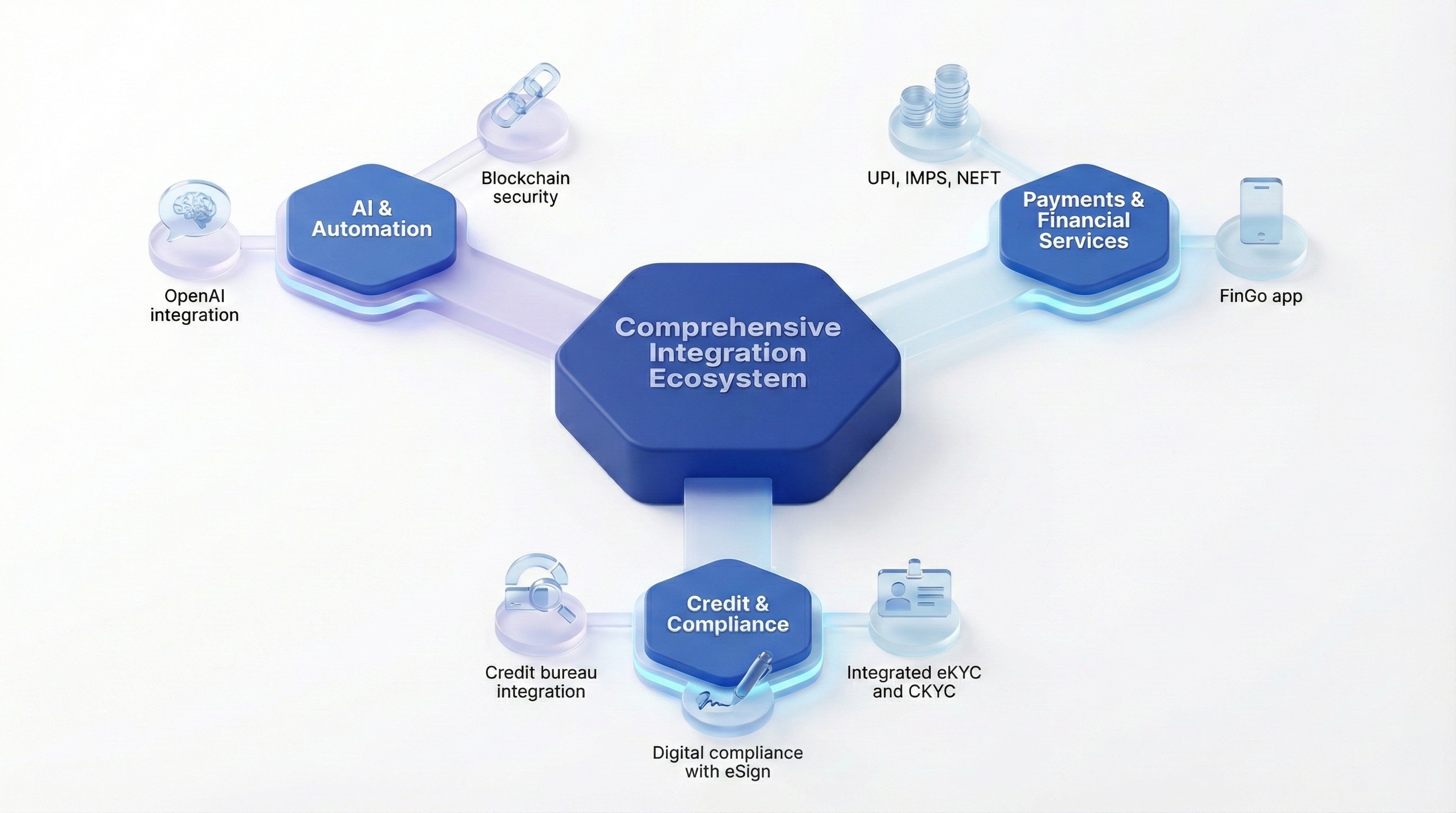

Comprehensive Integration Ecosystem

AI & Automation

- OpenAI integration powering AI copilots across modules.

- Blockchain security with Hyperledger Fabric for immutable audit and integrity.

Payments & Financial Services

- UPI, IMPS, NEFT integrations for seamless transactions.

- FinGo app: Unified mobile banking with UPI and loan management.

Credit & Compliance

- Credit bureau integration: Real-time CRIF, Equifax, and CIC connectivity.

- Digital compliance with eSign and Surepass integrations for paperless processes.

- Integrated eKYC and CKYC: Fully automated and regulation ready.

Transformational Impact & Proven Results

Operational Excellence

- Instant reports and live insights replacing week-old data.

- 24x7 decision access for CXOs and regional managers.

- Integrity assurance: Eliminates manipulation risk with direct data access.

Quantifiable Business Impact

- TAT reduced: 2-3 days to 15 minutes (Manappuram success).

- 85% reduction in report preparation time.

- Significant OPEX savings across PAN-India operations.

- Enhanced compliance: Automated audit trails and RBI reporting.

The Future of Banking Intelligence

Coligo and ibanker represent more than a software transformation - they embody the next era of banking intelligence, where AI bridges the gap between data and decision making.

Strategic Vision

- Democratized intelligence: Real-time insights via natural language.

- Operational transformation: Manual to automated workflows.

- Proactive risk management: Predictive insights before problems occur.

- Enhanced customer experience: Paperless, seamless, intelligent journeys.

Industry Impact

- Eliminating information asymmetry between leadership and operations.

- Transforming decisions from reactive to proactive.

- Making compliance effortless and continuous.

- Bringing AI accessibility to financial institutions of all scales.